-

.jpg)

We know that Southeast Asia has many unbanked and underbanked people. So, what are unbanked and underbanked people? Are they the same or different types of people in the financial world? Now you’ve got all the answers in this essay.

-

In the article Fintech company in Vietnam – is that a hard or easy market to grow? we recognized that many fintech startup companies in Vietnam have serious troubles that can stop the progress of startups on the way to becoming unicorns. In this essay, we will learn more about some serious troubles that these startups in fintech caused to the Vietnamese market.

-

Through the article Top 3 digital banks in Vietnam, we understand the definition of digital banks and the top 3 names in this field. In addition to the top 3 digital banks mentioned above, how many digital banks have been established and grown in Vietnam in recent years? Let’s find out with FinFan the answer.

-

.jpg)

In the article What are the differences between fintech and banks, we knew that fintech is the future and it can be more developed. Recently, many traditional banks in Vietnam (even Big 4 bankers) have established and developed many digital banks. Why are they doing this? Let’s find out the answer with FinFan in this essay.

-

Fintech in Vietnam has been growing strongly in recent years. Through this development, many companies become unicorns such as MoMo, VNPay, etc. In the article 4 Trends of Fintech in Vietnam 2023, we discussed 4 industry groups that have great growth potential and will achieve success in 2023. So, will crowdfunding become a trend in not only 2023 but also in the next 5 years? Let’s find out the answer with FinFan.

-

Fintech banks are technological banks, in which people can solve banking problems with technology and don’t need to go to the branches of banks for many troublesome procedures. It gives 2 types of fintech banks: NEOBanks and digital banks and FinFan discussed both types of fintech banks in our articles. Today, in this essay, let’s point out the list of NEOBank and digital banks in Southeast Asia.

-

.jpg)

Fintech is no longer strange to the Vietnamese technology world when it will be the future of the financial sector. Because of this many VCs (Venture Capitals), angel investors, and investment banks want to join and take the profit from this market. For the investment, they need to use platforms to connect and connect and approach many potential companies for investment. What are fintech investment platforms that fintech investors often use in Vietnam? Let’s find out with FinFan.

-

.jpg)

Fintech companies are companies working in financial technology (fintech) fields such as insurance, investing and banking is also an example. Today, let’s learn about the top 10 fintech companies and the growth in fintech investment in Vietnam with FinFan.

-

Fintech Vietnam has been growing flash in recent years. Many venture capitals, angel investors and funds want to join this hunt and have a big profit in the market. However, parallel with the development, fintech now still has some difficulties, that need emprise to be overcome on the road to success, especially in the banking field. So, in this essay, FinFan discusses this topic to find out Why and why not to have investment banking fintech.

-

Investment in fintech companies is always a tough decision for venture capitals, angel investors, etc. However, if the companies can overcome the seeding round and can continue to survive, that is the signal to a successful investment, which can multiply investors' returns by 10 times. Therefore, many firms want to take the risk to wait for the magic to happen in the future. Here are 10 firms like this.

-

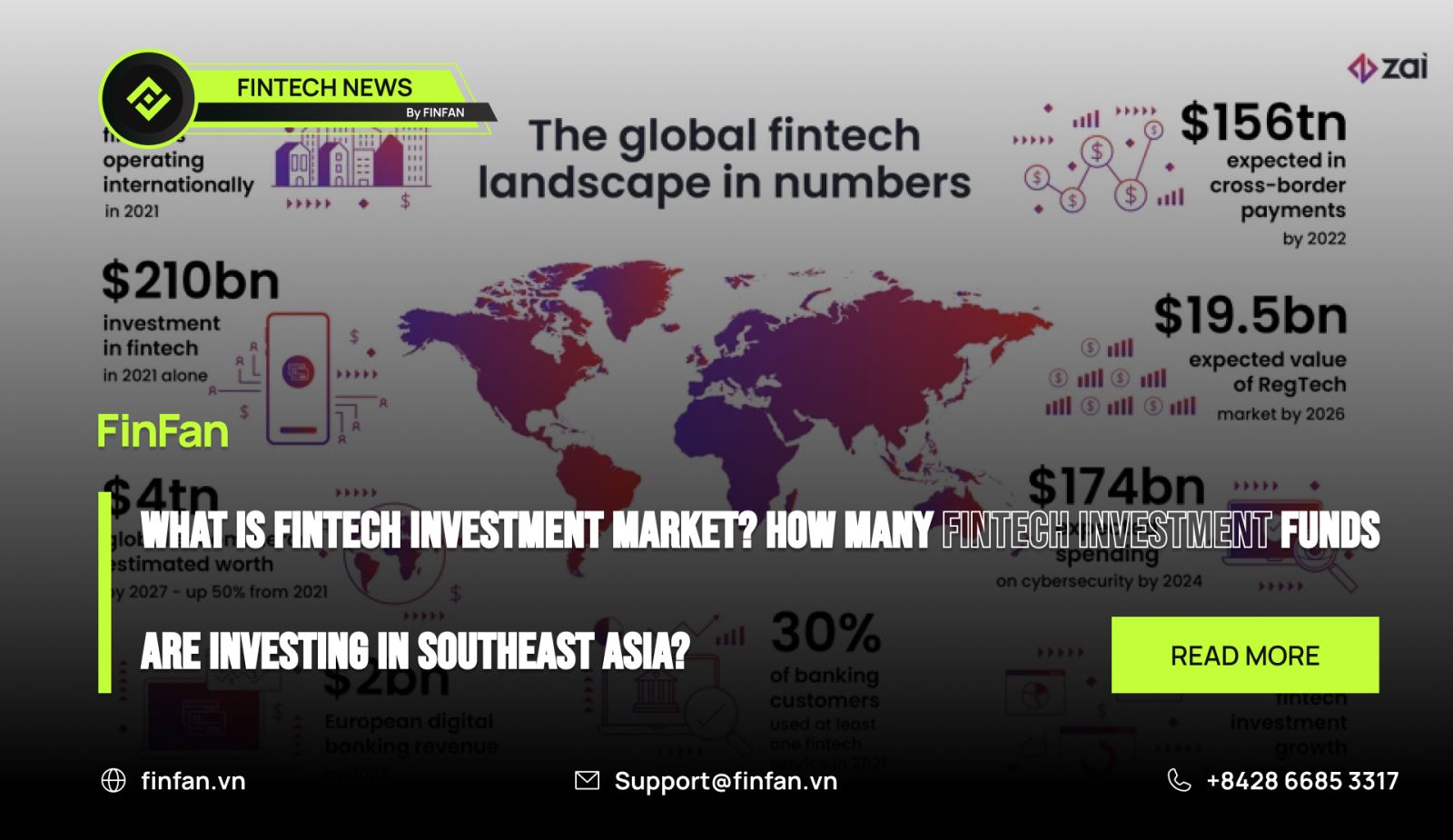

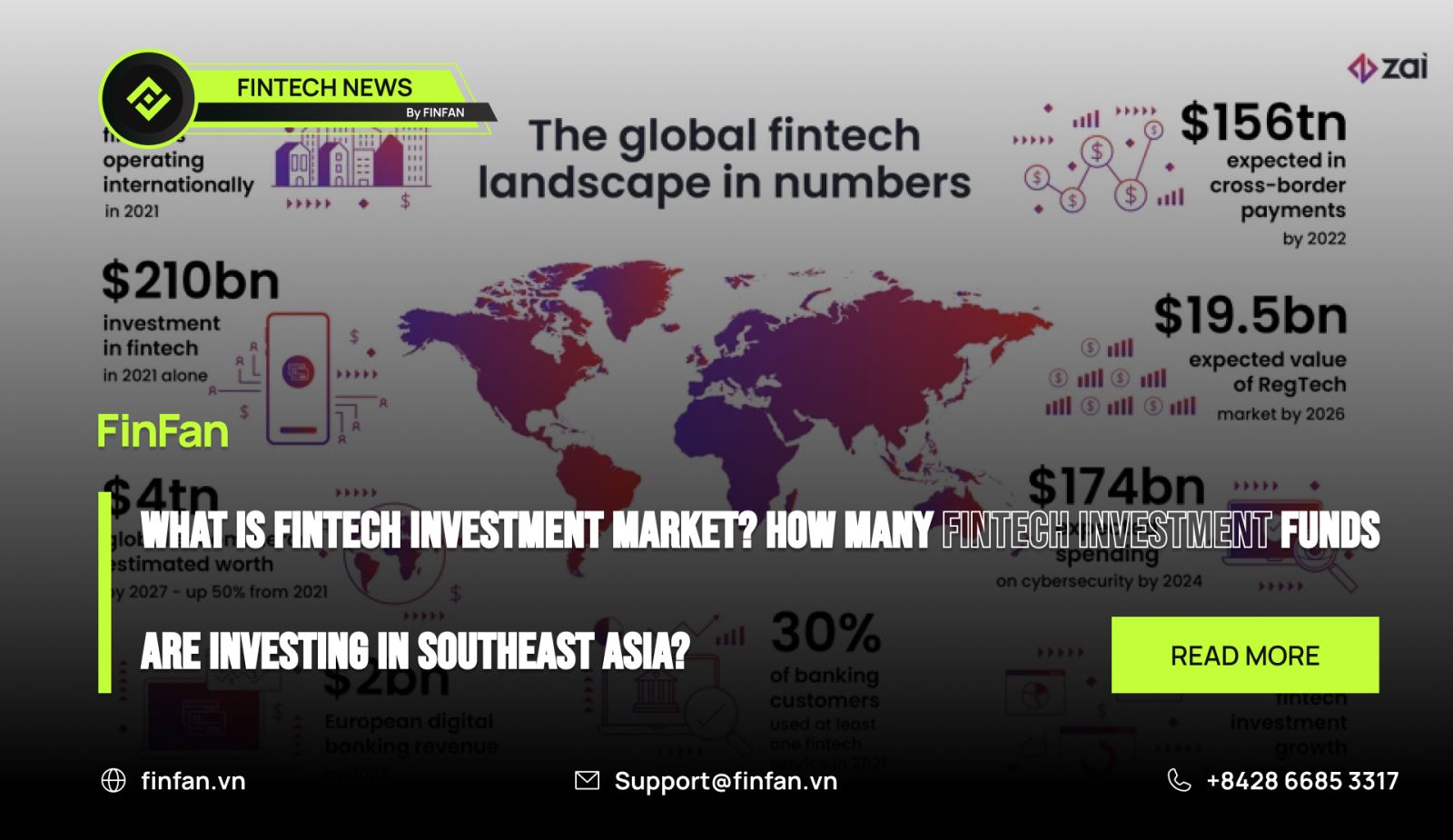

What is fintech investment and how many fintech investment funds, which invested in Southeast Asia? These questions will get answers now.

-

.jpg)

Peer-to-peer lending is a good business model, which is developing well because of the many unbanked and underbanked people in Vietnam. However, this model has still had some serious troubles in Vietnam, especially in legal. In this article, let’s find out with FinFan this problem.

.jpg) We know that Southeast Asia has many unbanked and underbanked people. So, what are unbanked and underbanked people? Are they the same or different types of people in the financial world? Now you’ve got all the answers in this essay.

We know that Southeast Asia has many unbanked and underbanked people. So, what are unbanked and underbanked people? Are they the same or different types of people in the financial world? Now you’ve got all the answers in this essay. In the article Fintech company in Vietnam – is that a hard or easy market to grow? we recognized that many fintech startup companies in Vietnam have serious troubles that can stop the progress of startups on the way to becoming unicorns. In this essay, we will learn more about some serious troubles that these startups in fintech caused to the Vietnamese market.

In the article Fintech company in Vietnam – is that a hard or easy market to grow? we recognized that many fintech startup companies in Vietnam have serious troubles that can stop the progress of startups on the way to becoming unicorns. In this essay, we will learn more about some serious troubles that these startups in fintech caused to the Vietnamese market. Through the article Top 3 digital banks in Vietnam, we understand the definition of digital banks and the top 3 names in this field. In addition to the top 3 digital banks mentioned above, how many digital banks have been established and grown in Vietnam in recent years? Let’s find out with FinFan the answer.

Through the article Top 3 digital banks in Vietnam, we understand the definition of digital banks and the top 3 names in this field. In addition to the top 3 digital banks mentioned above, how many digital banks have been established and grown in Vietnam in recent years? Let’s find out with FinFan the answer..jpg) In the article What are the differences between fintech and banks, we knew that fintech is the future and it can be more developed. Recently, many traditional banks in Vietnam (even Big 4 bankers) have established and developed many digital banks. Why are they doing this? Let’s find out the answer with FinFan in this essay.

In the article What are the differences between fintech and banks, we knew that fintech is the future and it can be more developed. Recently, many traditional banks in Vietnam (even Big 4 bankers) have established and developed many digital banks. Why are they doing this? Let’s find out the answer with FinFan in this essay. Fintech in Vietnam has been growing strongly in recent years. Through this development, many companies become unicorns such as MoMo, VNPay, etc. In the article 4 Trends of Fintech in Vietnam 2023, we discussed 4 industry groups that have great growth potential and will achieve success in 2023. So, will crowdfunding become a trend in not only 2023 but also in the next 5 years? Let’s find out the answer with FinFan.

Fintech in Vietnam has been growing strongly in recent years. Through this development, many companies become unicorns such as MoMo, VNPay, etc. In the article 4 Trends of Fintech in Vietnam 2023, we discussed 4 industry groups that have great growth potential and will achieve success in 2023. So, will crowdfunding become a trend in not only 2023 but also in the next 5 years? Let’s find out the answer with FinFan. Fintech banks are technological banks, in which people can solve banking problems with technology and don’t need to go to the branches of banks for many troublesome procedures. It gives 2 types of fintech banks: NEOBanks and digital banks and FinFan discussed both types of fintech banks in our articles. Today, in this essay, let’s point out the list of NEOBank and digital banks in Southeast Asia.

Fintech banks are technological banks, in which people can solve banking problems with technology and don’t need to go to the branches of banks for many troublesome procedures. It gives 2 types of fintech banks: NEOBanks and digital banks and FinFan discussed both types of fintech banks in our articles. Today, in this essay, let’s point out the list of NEOBank and digital banks in Southeast Asia..jpg) Fintech is no longer strange to the Vietnamese technology world when it will be the future of the financial sector. Because of this many VCs (Venture Capitals), angel investors, and investment banks want to join and take the profit from this market. For the investment, they need to use platforms to connect and connect and approach many potential companies for investment. What are fintech investment platforms that fintech investors often use in Vietnam? Let’s find out with FinFan.

Fintech is no longer strange to the Vietnamese technology world when it will be the future of the financial sector. Because of this many VCs (Venture Capitals), angel investors, and investment banks want to join and take the profit from this market. For the investment, they need to use platforms to connect and connect and approach many potential companies for investment. What are fintech investment platforms that fintech investors often use in Vietnam? Let’s find out with FinFan..jpg) Fintech companies are companies working in financial technology (fintech) fields such as insurance, investing and banking is also an example. Today, let’s learn about the top 10 fintech companies and the growth in fintech investment in Vietnam with FinFan.

Fintech companies are companies working in financial technology (fintech) fields such as insurance, investing and banking is also an example. Today, let’s learn about the top 10 fintech companies and the growth in fintech investment in Vietnam with FinFan. Fintech Vietnam has been growing flash in recent years. Many venture capitals, angel investors and funds want to join this hunt and have a big profit in the market. However, parallel with the development, fintech now still has some difficulties, that need emprise to be overcome on the road to success, especially in the banking field. So, in this essay, FinFan discusses this topic to find out Why and why not to have investment banking fintech.

Fintech Vietnam has been growing flash in recent years. Many venture capitals, angel investors and funds want to join this hunt and have a big profit in the market. However, parallel with the development, fintech now still has some difficulties, that need emprise to be overcome on the road to success, especially in the banking field. So, in this essay, FinFan discusses this topic to find out Why and why not to have investment banking fintech. Investment in fintech companies is always a tough decision for venture capitals, angel investors, etc. However, if the companies can overcome the seeding round and can continue to survive, that is the signal to a successful investment, which can multiply investors' returns by 10 times. Therefore, many firms want to take the risk to wait for the magic to happen in the future. Here are 10 firms like this.

Investment in fintech companies is always a tough decision for venture capitals, angel investors, etc. However, if the companies can overcome the seeding round and can continue to survive, that is the signal to a successful investment, which can multiply investors' returns by 10 times. Therefore, many firms want to take the risk to wait for the magic to happen in the future. Here are 10 firms like this. What is fintech investment and how many fintech investment funds, which invested in Southeast Asia? These questions will get answers now.

What is fintech investment and how many fintech investment funds, which invested in Southeast Asia? These questions will get answers now..jpg) Peer-to-peer lending is a good business model, which is developing well because of the many unbanked and underbanked people in Vietnam. However, this model has still had some serious troubles in Vietnam, especially in legal. In this article, let’s find out with FinFan this problem.

Peer-to-peer lending is a good business model, which is developing well because of the many unbanked and underbanked people in Vietnam. However, this model has still had some serious troubles in Vietnam, especially in legal. In this article, let’s find out with FinFan this problem.