Vietnam fintech – Does Vietnam fintech have the best fintech investment in Southeast Asia?

In recent years, Vietnam has always been on top of these nations regarding the development of GDP (Gross Domestic Product) and FDI (Foreign Direct Investment).

Therefore “Is Vietnam fintech the best fintech investment in Southeast Asia” is always a tough question. In this essay, we will have the answer.

The development of Vietnam fintech in 10 years

Since 2007, the fintech industry in Vietnam has developed in three segments:

- Online Payment

- Peer to Peer Lending

- Digital bank or NEOBank

Online Payment

It was in 2007, the owners of M-Service run the first business modal “online mobile recharge” in the Vietnam fintech market. However, after 2 years of operation, this modal failed, and the owners determined to change the business modal because of the developing technology in this period with the appearance of smartphones.

They decided to change the business modal to mobile payment and created and uploaded an app named MoMo on the Appstore and Google Play (for Android).

This app has taken much positive feedback from users and they “have been driving on the Success Road” with this idea. MoMo has become a unicorn fintech start-up and continued to grow faster and faster.

After the success of MoMo, a series of fintech giants in the market have stepped into the e-wallet market. However, few of them can be successful like MoMo.

Peer-to-peer lending

With the rate over 67% in 2021, unbanked and underbanked are still the wall separating lots of Vietnamese people from traditional banking services. Therefore, they look up to peer-to-peer lending solutions to solve their financial problems.

According to the research of Vietnam Net, in 2012, P2P outstanding loans worldwide totaled $1.2 billion, while the figure rose to $64 billion in 2015 and is expected to reach $1 trillion by 2025.

A big advantage of the P2P model is the high information security level based on Big Data technology which encrypts, stores and controls customers’ information.

Analysts said with the advantages of the model, plus current conditions in Vietnam, P2P could replace black credit, or lending at very high interest rates, which is illegal in Vietnam.

Digital bank or NEOBank

E-banking or digital banking has been growing strongly after the effect of COVID-19.

VietABank, PVcomBank, VietinBank, Techcombank, SeABank, ABBank and OCB have all integrated cloud computing technologies to launch new digital banking platforms serving the sales of retail products and services, attracting millions of users.

The business results by the end of 2022 of banks showed a sharp increase in the number of new customers attracted by banks thanks to their digital applications.

For example, MB last year added 7 million customers in the wake of developing Biz MBBank and Charity app while Techcombank with E-Banking apps (using AWS cloud computing technology) attracted an additional 1.2 million users in 2022. ACB and TPBank also said they recorded an annual growth of 30 percent in the number of customers using digital applications in the 2019-22 period.

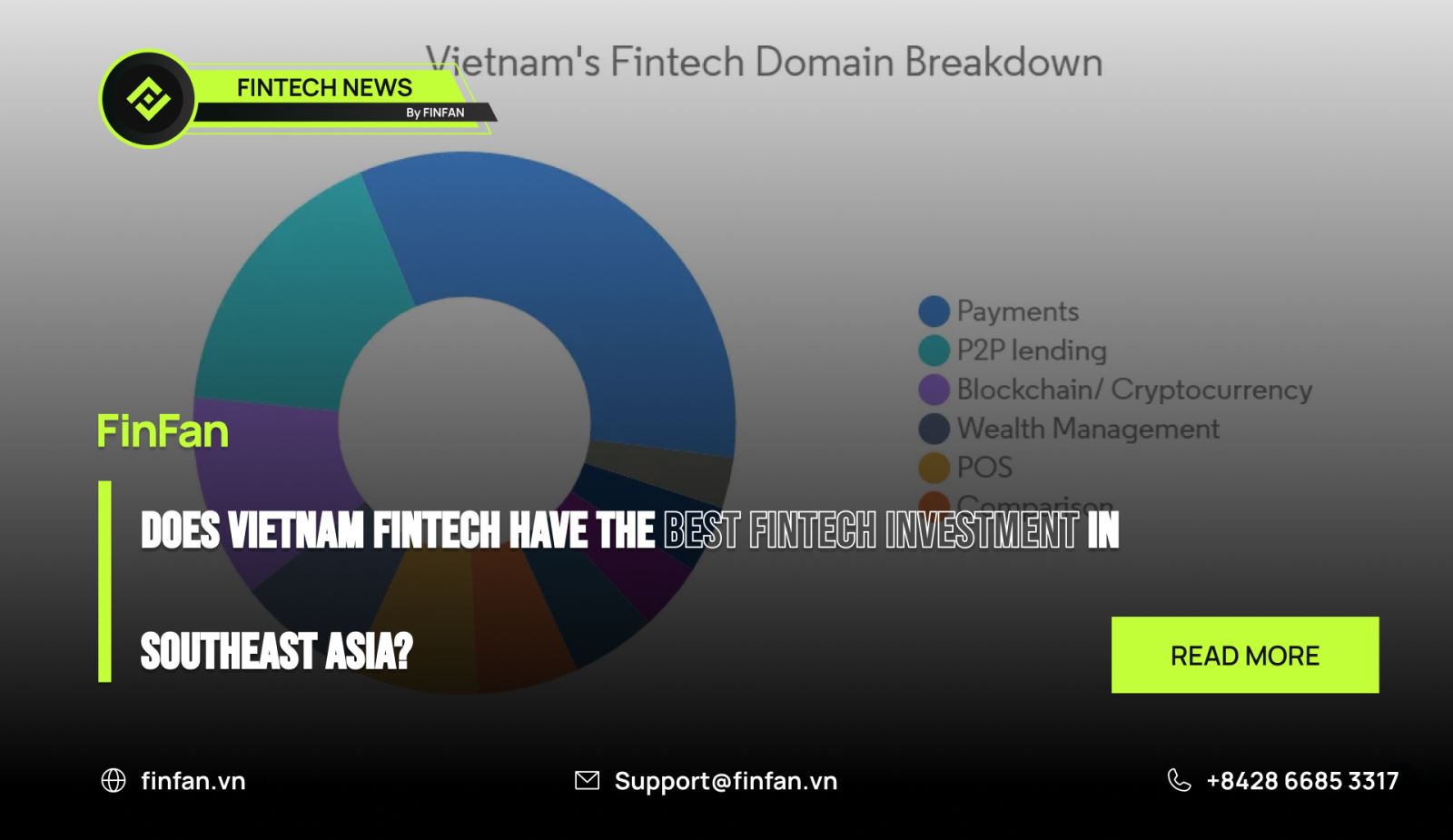

Does Vietnam fintech have the best fintech investment in Southeast Asia?

That is the tough question. Established in Vietnam, FinFan always hopes that Vietnam fintech can have a company in the top 1 of fintech investment in Southeast Asia.

However, besides Vietnam, Southeast Asia has also 2 countries with the strongest technological development Indonesia and Singapore, both are still the biggest fintech markets, which attract lots of investors in the region.

Read more: