Cross-border payments, Deep dive into the money transfer market

What is Cross-Border Payment?

Currency transactions involving people, businesses, banks, or settlement organizations operating in two or more countries throughout the world are referred to as cross-border transactions.

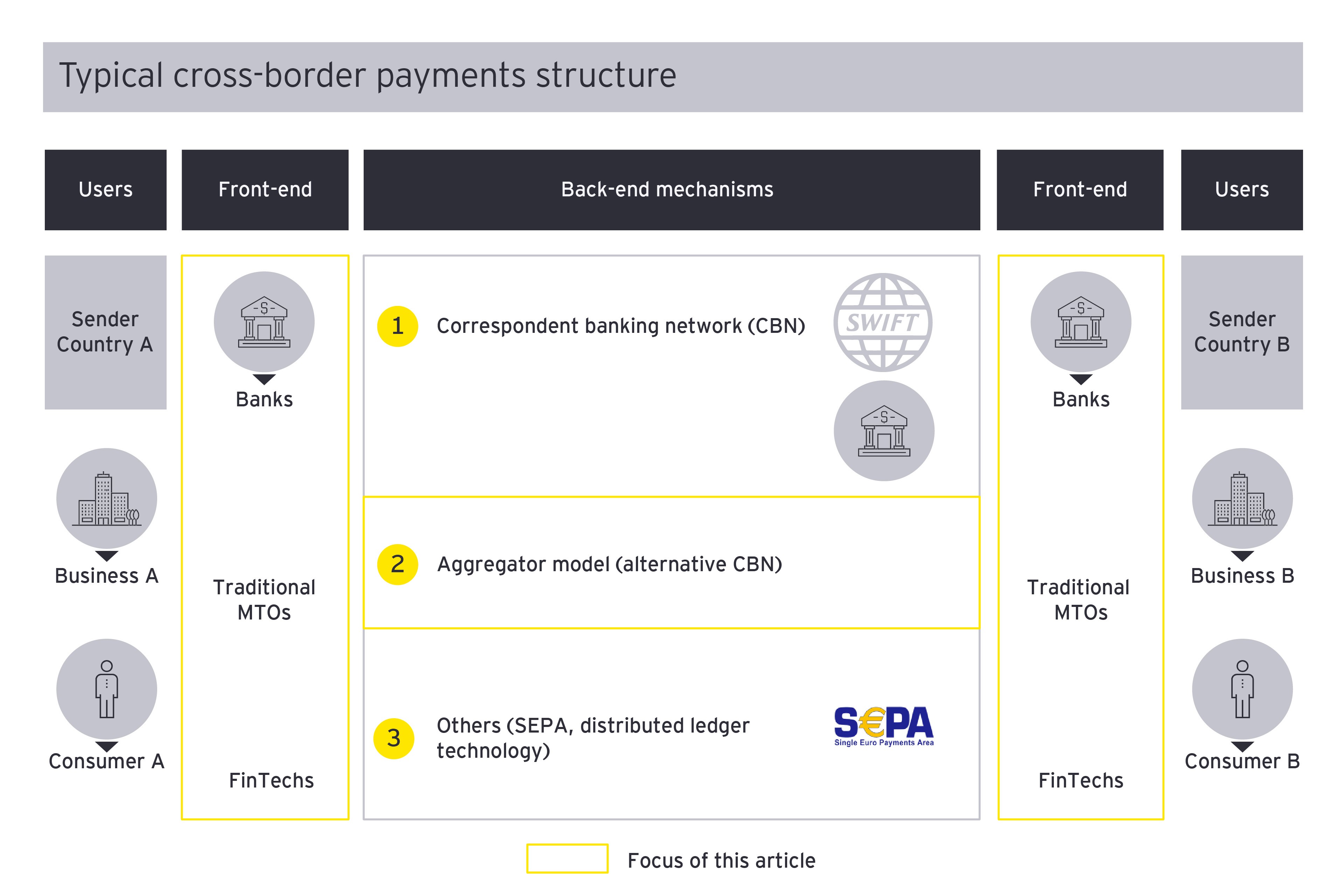

To execute a cross-border payment transaction, the money sender will generally select a front-end provider, such as a bank or a money transfer operator (e.g., Western Union, Transferwise). The money is subsequently delivered to the receiver via the media selected by the sender. Traditionally, payments beyond nations are routed through the correspondent banking network (CBN), which is used by the majority of front-end providers to settle payments. Meanwhile, in recent years, new backside networks have emerged to accelerate the growth of global money transfers, facilitate interoperability across payment systems, and offer senders with more options for reaching the receiver.

What are cross-border payment transactions?

Did you know that by 2022, worldwide cross-border transfers flows are anticipated to surpass US$156 trillion? This trillion-dollar trans-national payment sector is in disarray, shook by a slew of new entrants. Many people are watching them since they promise to assist consumers in resolving long-standing tiredness issues. Existing banks and third-party payment and money transfer operators (MTOs) must consider the implications of these developments on their future strategy.

How do cross-border payments work?

In the payments industry, currencies are closed-loop mechanisms. Because domestic payment systems are not directly linked to those of other nations, when a transfer is made between two jurisdictions, the currency is not physically transported outside.

International banks, on the other hand, provide accounts for overseas counterparts and maintain their own accounts with their foreign counterparts, allowing banks to make payments beyond borders in foreign currency. The money is not transferred across borders; rather, accounts are credited in one jurisdiction and debited in the other. This interbank network is used by other payment providers, such as Fintechs and money transfer agencies, to provide payment services to companies and people.

Figure 1: A simple cross-border payment using accounts held at each bank

In Figure 1, for example, Bank A will send a message to Bank B ordering them to make money transcend across the border on behalf of a client. Bank B will then credit the end customer's account with funds from Bank A's account at Bank B. A payment message sends an instruction to debit an account in Bank A and credit an account in Bank B. However, not every bank has a direct connection, therefore they must occasionally trade via an intermediary, known as a "correspondent" bank. This is a bank that provides accounts for Bank A and Bank B even though they do not have a direct connection.

Figure 2: A cross-border payment using a correspondent bank

Bank A and Bank B do not have accounts with each other so they use a bank where they both hold accounts — the correspondent bank to execute a cross-border payment.

The greater the number of intermediaries engaged in transnational transfers, the slower and more expensive it will be. A shorter chain is generally found for currency pairs with significant payment volumes (for example, the US dollar to the British pound sterling). However, more correspondent banks are involved in currency conversions with a lesser volume of payments. The more correspondent banks involved, the longer the transaction will take and the higher the fees at each point of the chain will be. The ‘country corridor' or ‘payment corridor' is the collection of payment flows that connects one nation to another.

Figure 3: Cross-border payment using the correspondent-banking network

The less common the currency pair, the more correspondent banks will be required to make payments across borders, incurring costs and delays at each stage. Fees for processing and foreign exchange will be charged at each bank in the chain, payment messages will be checked against local financial crime requirements, and each bank will be required to update the balances in the accounts of the incoming and outgoing payees using their domestic payment systems, which are only open during normal business hours. The sender's bank must keep enough cash on hand to cover these uncertain fees until the payment is completed.

Types of cross-border payments

Cross-border payment includes credit card payments, bank transfers, and APMs. Customers want to pay in the manner that is most convenient for them. Furthermore, they like to be presented with personalized options and have the assurance that their financial information will be handled securely. As a result, retailers as well as cross-border payment companies, including several C2C or B2B cross-border payments must cover all bases and provide numerous options for their consumers to pay across borders.

B2B cross-border payments

According to a recent Juniper Research research, the overall value of B2B cross-border payments will reach $35 trillion in 2022, up 30% from a low of $27 trillion in 2020, thanks mostly to the influence of COVID-19. This is a sector ripe for innovation and growth, with the future years promising to be exciting for international B2B payments between nations. Travel and hospitality, in particular, are set to benefit from the projected simplification of cross-frontier trade.

FinFan is B2B fintech & cross-border Finance

Credit card cross-border payments

Credit cards play an important part in transcending money across nations and are a popular payment method for many customers. From the consumer's perspective, all they have to do is input their credit card information and wait for the transaction to be confirmed. There is more going on behind the scenes. It is a dependable method of payment when going overseas. A credit card reduces the need to carry cash on one's person. They also provide appealing features like interest-free borrowing periods (of one month or more), reward points, gift vouchers, shopping deals, simple EMI choices, travel insurance perks, and so on. Supranational needs greater effort from the credit card networks and acquiring banks involved as they need to convert between two different currencies. This additional workload results in increased fees that are passed down the payment chain.

Cross-border Bank Transfers

International bank transfers are another traditional method of moving money across bounders. Most bigger banks will keep a limited selection of currencies on hand, but only a few can be accommodated at any given time. As a result, when a client in the UK wants to transfer money to a nation where they don't have the currency in store, they must rely on their overseas banking partners to facilitate the transaction. Smaller banks frequently do not have any foreign currency on hand, therefore they rely on major banks to handle international transfers on their behalf.

This is only a snapshot of trade processing across borders; there may be many more parties involved, causing the transaction to be delayed. SWIFT gpi, which we shall go over in more detail later, is an attempt to speed up the processes involved in transcending money across continents.

eWallet: An arising cross-border payment solution

Among different trans-frontier trading methods, an eWallet - also known as a digital wallet, is a software-based electronic payment method that enables users to pay for online and in-store transactions. Card numbers, account numbers, expiration dates, IFSC codes, and other information are stored in digital wallets, which are subsequently stored on the cloud. eWallets, which are often available through apps for smart devices, allow users to securely save their preferred payment cards so that they may pay for items and services. Popular eWallets include, but are not limited to, Paypal, Neteller, Skrill, Alipay, Apple Pay and Google Pay.

Although wallet to wallet transactions do not technically count as global transfer, they do help facilitate the transaction. Some eWallets allow consumers to operate in multiple currencies and to place orders across borders. It is not until the funds are withdrawn from the eWallet and transferred to the merchant’s bank account, that the process can be classified as borderless payments.

Challenges with cross-border payments

Cross-border payment companies lag domestic counterparts in terms of cost, speed, access and transparency. Making a payment from one nation to another is generally more complicated than making a similar payment inside the same country. An overseas payment can take several days and cost up to ten times more than a local transfer in some cases.

The G20 has designated improving the global transfers of money as a priority for 2020. This effort includes identifying the issues that result from a number of frictions in existing procedures and designing a set of building blocks to address them. The following are the main points of contention:

Fragmented and truncated cross-border data formats

In the payments industry, payments are made by messages sent between financial institutions to update the accounts of the sender and recipient. These payment messages need to contain sufficient information to confirm the identity of parties to the payment and confirm the legitimacy of the payment. Data standards and formats vary significantly across jurisdictions, systems and message networks.

For example, during trans-boundary transfers, some formats only allow Latin characters, and some formats allow more data than others, meaning names and addresses in other scripts have to be translated, leading to divergences in precise spellings. This makes it difficult to set up automated processes, causing delays in processing and increased technology and staffing costs.

Complex processing of cross-border compliance checks

Uneven implementation of regulatory regimes for sanctions screening and financial crime mean the same global payments may need to be checked several times to ensure that the parties are not exposing themselves to illicit finance.

International banks may use different sources for conducting their checks which can lead to payments being incorrectly flagged (for example where entities have similar names to those on sanctions or financial crime databases). This complexity increases with the number of intermediaries in a chain, as the original data provided to meet initial checks may not contain elements needed for checks under other national regimes. This makes compliance checks more costly to design, hampers automation and leads to delays or the rejection of payments.

For example, a cross-border transaction from a local bank account in Vietnam to a bank account in the United States can cost more than $100, depending on the transaction value, and can take up to seven days to clear. decide. And even then, the sender usually won't get a notification when the transactions are successful.

Limited operating hours during global cross-border payments

In the money transfers market, balances in bank accounts can only be updated during the hours when the underlying settlement systems are available. In most countries, the underlying settlement system’s operating hours are typically aligned to normal business hours in that country. Even where extended hours have been implemented, this has often been done only for specific critical payments. This creates delays in clearing and settling the payments, particularly in corridors with large time-zone differences. This causes delays and also means banks need to hold enough cash to cover the unknown costs of the eventual foreign exchange rate, which fluctuates during this time, driving up the overall cost of the transaction. This is known as trapped liquidity.

Legacy cross-border technology platforms

A significant proportion of the technology supporting interregional transfers systems remains on legacy platforms built when paper-based payment processes were first migrated to electronic systems.

Cross-border payment companies have fundamental limitations in their platforms, such as a reliance on batch processing, a lack of real-time monitoring, and low data processing capacity. This creates delays in settlement and trapped liquidity. These limitations affect domestic operations, but become even more of a barrier to achieving borderless automation of payments when different legacy infrastructures need to interact with each other. The requirement to interface with legacy technology can act as barriers for emerging business models and technologies to enter the market.

Long transaction chains in payments industry

These frictions make it costly for supra-national banks to have relationships in every jurisdiction. This is why the correspondent banking model is used but this results in longer transaction chains, which in turn increases cost and delays, creating additional funding needs (including to cover unpredictable fees deducted along the chain), repeated validation checks and the potential for data to be corrupted through its journey.

Expected global cross-border payment market size in 2022

These realities within the cross-border payment industry are already ripe for disruption, and in recent years, we've seen a slew of new actors enter the fray to 'save' them. As incumbents and new entrants discover their own optimal development route, the market environment shifts. They have their own identity and are always competing with one another in terms of geography, transaction volumes, and payment categories. Such conditions are ideal for disruption, and several new companies have entered the cross-border payments fintech industry in recent years to accomplish exactly that. With firms concentrating on different locations, transaction sizes, and payment categories, the environment is becoming increasingly fragmented and competitive.

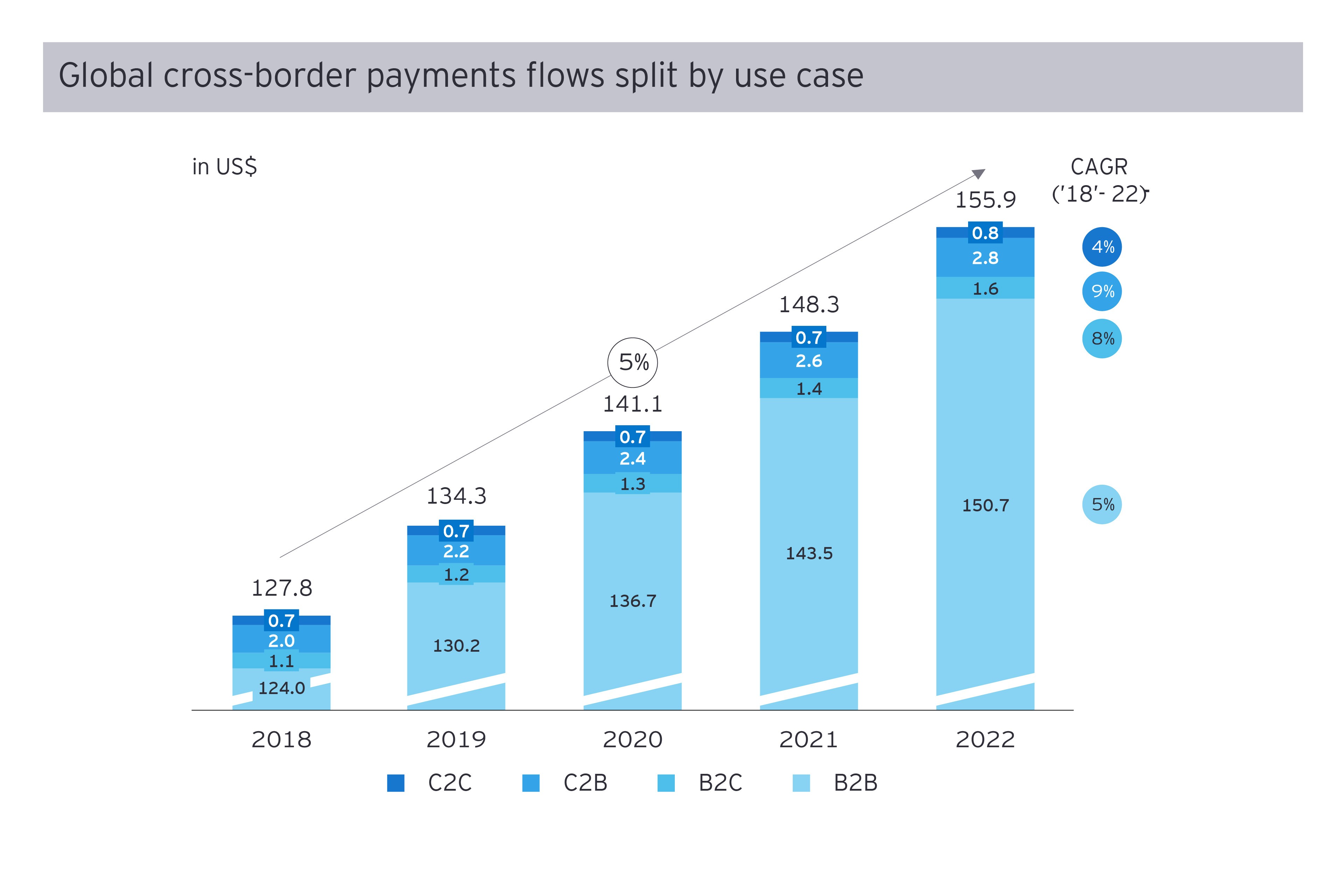

The cross-border payments market size ensures its attractiveness to new entrants. Total global transaction flows are growing by about 5% (CAGR) per year and peaking at US$156 trillion by 2022. Of this total:

- Business-to-business (B2B) transactions account for the largest share by far, expected to account for US$150 trillion.

- Consumer-to-Business (C2B) transactions, such as global e-commerce and offline travel spending, are forecast to reach US$2.8 billion.

- Business-to-Consumer (B2C) transactions, including wages or interest payments, are expected to amount to US$1.6 billion by 2022.

- Consumer-to-consumer (C2C), or payment by remittance, contributes the least - projected to reach US$0.8 billion by 2022.

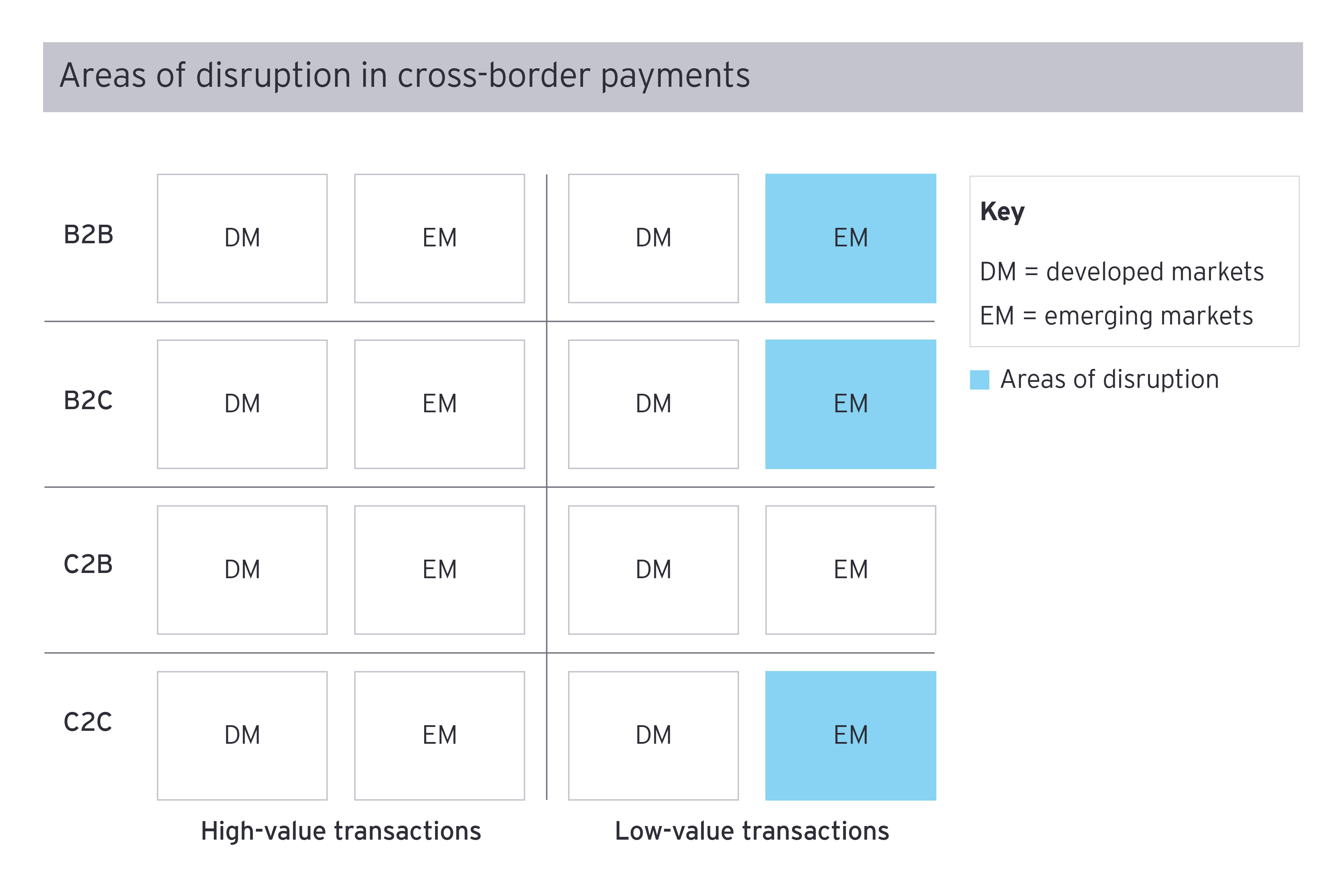

But while many new entrants aim to change the nature and inherent dynamics of the entire cross-border payments market size, most focus on low-value transactions in the C2C segment. , B2C and B2B, which are not currently served by incumbent banks and traditional payment providers. These low-value transactions from emerging markets offer the highest likelihood of disruption due to consumer behavior, increased trade with emerging markets, and greater financial inclusion.

Trends towards cross-border payments fintech

Trend 1: Changing consumer exigencies within payments market

The growing growth of the money transfer market is closely linked to the needs of consumers that are changing and evolving towards digital. Consumers are less willing to pay for banking services while expecting them to be quick and intuitive. The increasing penetration of smartphones and the proliferation of digital hotspots as alternative payment methods (APMs) for money transfers and online purchases have created new demands that incumbents struggling to find answers Alternative payment solutions providers that offer faster, cheaper and more transparent cross-border payment solutions can gain a competitive advantage over with traditional banks.

Trend 2: Increased trade with emerging money transfer markets

A key trend in the cross-border payments industry is an increasing focus on emerging markets in Africa, Latin America and Asia Pacific, as their share of international transactions increases. Overall, international trade is expected to grow by around 5% (CAGR) from 2018 to 2022, with the majority coming from emerging markets, where growth is estimated at around 11% (CAGR) between 2018 and 2022, driven by initiatives such as the Africa Continental Free Trade Area and China's Belt and Road Initiative. By contrast, protectionist policies in developed markets, including Brexit and US trade tensions, are expected to slow growth to around 2% (CAGR) from 2018 to 2022 within the cross-border payments market size.

Trend 3: Accessibility of mobile phones and electronic cross-border payments

As mobile phone ownership increases, more people around the world have access to banking services and electronic cross-border payment solutions. Mobile phone ownership among adults in emerging economies has increased to around 83% (PEW Research), while promoting financial inclusion - in 2017, 69% of the world population with a bank account and/or mobile wallet, up from 62% in 2014 (World Bank).

This number is expected to grow in the coming years with the mobile wallet forecast to grow significantly. The use of global mobile wallets at point of sale (POS) is expected to change from c. 22% in 2019 to c. 30% by 2023, while the use of mobile wallets in e-commerce is forecast to increase to more than half (about 52%) by 2023, from c. 42% in 2019 to c. 52% in 2023 (Worldpay). This growth is increasing the volume of trade across the globe. Together, these trends create the need for new business models and value propositions that address existing process bottlenecks with correspondent banks.

Trend 4: More “X”-as-a-Service during cross-border payments fintech

The payments market witnesses a growing number of businesses-as-a-service, from Payment as a Service; Banking as a service to Money transfer as a service. In 2020, we will see “X”-as-a-Service services gain significant grounding as a means of powering some of the biggest names in fintech.

In 2021, this trend will not only continue, but expand into new corners of the cross-border payments industry, with products likely to emerge to serve a wide range of customers, primarily in B2B. The "X" -as-a-Service model is especially good when it can solve peripheral problems at a cheaper cost than the internal model - and there are many such areas across borders.

The Rise of Experts: New entrants challenge incumbents with innovative cross-border payment business models

These trends and the traditional pain points around cross-border payment companies – delays, high costs and lack of transparency - have led to the emergence of two new specialized groups of players: digitally-enabled money transfer operators and back-end systems.

Digital Support Remittance market Operators

Deal directly with the sender - the consumer or the seller - and make digital cross-national payments their core business. When working with liquid currency pairs (e.g. USD/EUR), these providers often establish direct banking relationships in sending and receiving countries, with net payments circulating between these countries. However, in many emerging markets, setting up a bank account can be a challenge, and capital controls often impede payment flows. Financial inclusion in these countries also tends to be lower, and payment methods are highly fragmented. These conditions mean that digital money transfer operators often depend on partners, such as back-end infrastructure providers, in these countries.

Back-end cross-border payment networks

With the current cross-border payments fintech, there is no direct relationship with the sender or receiver, but instead cooperates with their banks or wallet providers. By establishing a partner network through direct connection with local banks and APM in both liquid and illiquid markets, the backend network enables interoperability in payments beyond boundaries. For example, a Paypal account can transfer a deposit in Euros to an M-Pesa account in Kenia Schilling. As this is not possible with CBN, front-end vendors are increasingly using these alternative backside networks instead of using traditional banking rails.

The high fragmentation of the global payments industry and different regulatory requirements mean that back-end networks are often concentrated in certain countries or regions. As a result, a sending partner, such as an MTO, will need to connect to several back-end networks to provide a truly global solution to customers.

In the cross-border payment networks, back-end networks often use an aggregation model. Aggregation of payments reduces costs, as most fees are incurred as a flat fee per transaction. In addition, to enable real-time payment confirmation, logistics providers often require pre-payback to their sending partners as collateral. This advance payback of the sending partner allows logistics providers to credit the recipient's account in real time after the transaction has been initiated.

This aggregate transnational business model is especially applicable to transactions in the C2C, C2B and B2C segments, which are often low value. Back-end structures can settle these transactions faster, cheaper, and more transparently than transactions handled by CBNs.

Aggregate models are less successful in the B2B segment, where the average cross-border transaction value is typically higher than $50,000. Ensuring the ability to repay such high values upfront would require depositors to significantly increase their working capital requirements. These models also offer less potential for cost reduction, as current unit economics for B2B transactions are better, due to higher mean and fixed nature of fees. For these reasons, almost all high-value B2B cross-border payments are still processed through CBN.

Cross-border payment industry expects greater collaboration as differentiated strategies emerge

Business-initiated cross-border payments

For cross-border transactions between developed markets, CBN remains relatively efficient and reliable- we expect banks to continue to dominate these segments.

In emerging markets, the picture of the money transfer market is more fragmented. Banks are expected to continue to dominate high-value transactions, where relatively low costs and high working capital requirements hinder aggregators. However, if this working capital barrier can be overcome, we expect cooperation between aggregators and banks as well as MTOs to present more enhanced cross-border payment solutions. Meanwhile, these partnerships may fall within the low-value B2B transaction segment, as aggregators offer cheaper and more reliable solutions.

Vertical integration with limited feasibility across payment market

Upon heading to cross-border payment fintech, Aggregates may appear interesting targets for large MTOs and banks, but we don't expect many to want to sell to them. It is the independence of these front-end players that is key - otherwise, they enter head-to-head competition with the rest of their counterparts, destroying most of their chances. Any potential buyer needs reliable independence, such as a card network. We expect moderate M&A activity in the consumer space at the regional level, driven by economies of scale in regions with similar regulatory environments, for example, regarding rules on your customer (KYC).

Toward the cross-border payment fintech

Changes in the massive cross-border payments fintech industry present opportunities across the entire value chain, possibly including new acquisition strategies. However, such a complex and highly differentiated market also poses challenges for both incumbents, new entrants and investors – finding the right path will require a Careful strategy based on deep knowledge of local market and industry.